Most people while buying any vehicle be it new or old are not able to find out its real price because there are some things about which they do not have any information and this can cause them loss. Also most people are interested in buying vehicles auctioned from finance companies for a good price after buying them they might regret later because there are some things which are very important to know through which you will be able to find out the real price of any vehicle.

IDV: Insured Declared Value.

Often you must have heard about IDV in insurance or many people do not know about IDV.

IDV is the part of insurance policy where the vehicle value is declared by the insurance company. The IDV value shows the maximum amount will be claimed from the insurance company.

IDV shows the value of the vehicle at the time of insurance and hence its premium is decided by it. If your vehicle gets stolen, the maximum amount you will get is known from IDV.

If you buy or sell a car at a good price but the price you don’t guess what is the actual price to buy or sell. Then you can find the IDV in the car insurance policy letter. You can also calculate IDV by the IDV Calculator from the insurance companies website.

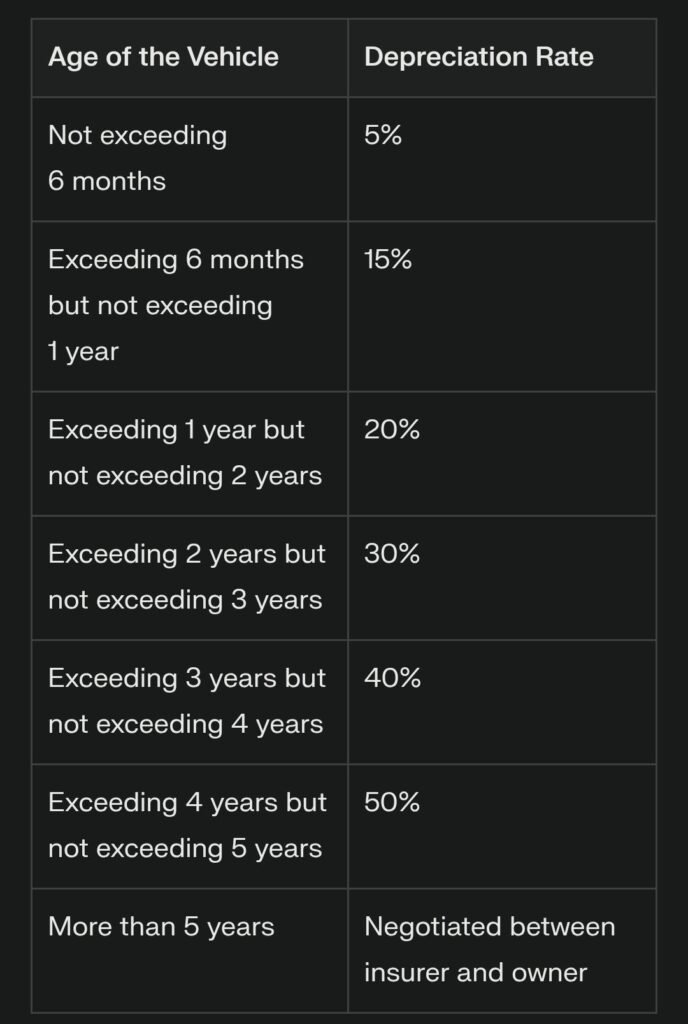

If the IDV is high then the claim value will also be high and if the IDV is low then the claim value will also be low. The IDV reduces every year because the vehicle depreciates in value every year which is called depreciation. Depreciation is a term used to describe the gradual decrease in the value of an asset over time.

Let us know how the IDV of a vehicle is determined.

IDV Formula:

IDV = Ex Showroom Price – Depreciation

Example Calculation:

Ex-showroom Price: ₹10,00,000

Vehicle Age: 2.8 years → Depreciation = 30%

IDV = ₹10,00,000 – 30% = ₹7,00,000

Vehicle Price is 700000/- .

This way to find the actual value of any vehicle.

Point to be noted:

IDV differs from the type of vehicle and manufacture age and insurance companies policies. Lets see what the point to be affect the IDV.

1.Age of the Vehicle and Depreciation.

2.Manufacturer’s Listed Selling Price.

3.Type and Segment of the Vehicle.

4.Modifications affect the Insured Declared Value.

5.Condition of the Vehicle and Additional Accessories.

6.Geographical Location or Place of Registration.

7.Insurance Company Policies.

8.Some insurance agents insured the vehicle for higher IDV for higher claim.

9.Some insurance agents insured the vehicle for a lower premium to save money for their customers.